India’s Textile Sector at a Global Inflection Point

- Atulkumar Singh

- Jul 2, 2025

- 2 min read

With the Government of India actively pursuing trade agreements with key economies such as the UK, EU, and the USA, India’s textile export sector is well-positioned for robust expansion in the coming years. Contributing approximately USD 37 billion annually, the textile and apparel industry remains a cornerstone of the country’s export economy. As the third-largest contributor to India's export basket, the sector plays a pivotal role in advancing the nation’s global trade objectives.

As India advances trade negotiations with major economies such as the UK, EU, and USA, new prospects are emerging for enhanced market access, tariff reductions, and streamlined compliance frameworks. These anticipated agreements are expected to elevate India’s competitiveness on the global stage—particularly in comparison to other cost-effective manufacturing hubs like Bangladesh and Vietnam.

For stakeholders across the textile value chain—manufacturers, exporters, and strategic advisors alike—this moment offers a critical opportunity to recalibrate export strategies, broaden product portfolios, and reinforce India’s stature as a global leader.

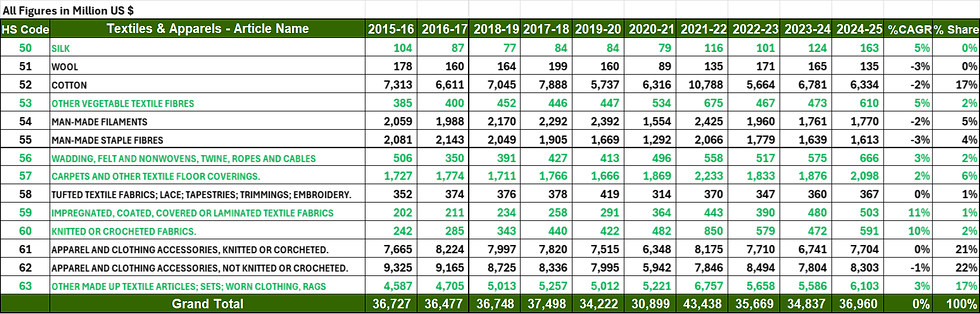

Against the backdrop of evolving trade dynamics, this analysis examines India’s textile and apparel export performance over the past decade. According to the Ministry of Commerce’s latest data for FY 2024–25, the sector’s exports have held steady at approximately USD 37 billion, highlighting a strong undercurrent of resilience amid mounting global competition and enduring structural headwinds.

A key strategic insight lies in pinpointing product segments that have demonstrated consistent export growth over the past decade. Traditional categories—such as cotton textiles, yarns, woven fabrics, and apparel—have faced mounting competitive pressures. In contrast, specialized segments including home textile made-ups, carpets, knitted and coated fabrics, felts, and nonwovens have exhibited steady and resilient expansion. Nonetheless, apparel, home textile made ups, spun yarns, and woven fabrics continue to account for the majority share of India’s textile export portfolio.

Apparel continues to dominate India’s textile export portfolio. In the absence of duty-free trade agreements, the United States remains the leading destination, while the EU27 and the United Kingdom serve as key secondary markets.

With key trade agreements on the horizon, India’s exports of finished consumer goods—particularly apparel and home linen made-ups—are nearing a potential turning point. Proactive, strategic engagement with major international markets could unlock fresh growth opportunities and further cement India’s role as a vital force in the evolving global textile landscape.

_edited.jpg)

Comments